Every startup is an experiment, and since the future is uncertain , it’s never clear which path they should take. Startups are agile and nimble , and they have lots of opportunities, because they are starting with a clean slate. While this can be very exciting, this also means that the danger is that they can get lost because they get tempted to go down many rabbit holes.

This creates tension . The founder wants to do lots of different things , because he dreams big ; while the investor wants to make sure that the entrepreneur doesn’t run out of money in the pursuit of his dreams. This is why they often seem to be at cross-purposes.

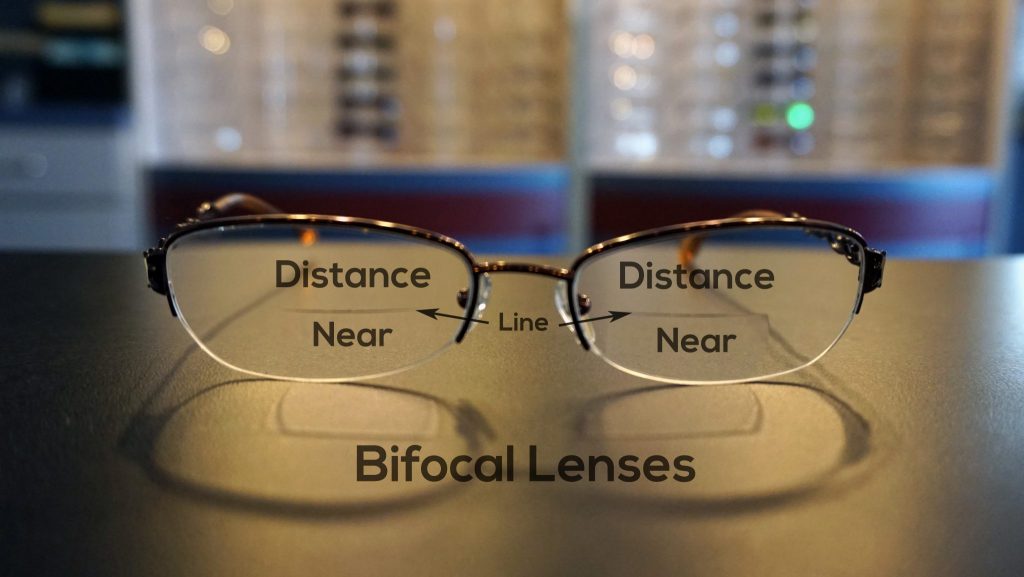

It’s important that they use the bifocal lens framework which aligns their interests, so they can dream big, but start small. It’s helpful to think of this as a two step process. Initially , you use a divergent model , where you brainstorm and use lots of blue ocean thinking to come up with all the possible options you can explore. Then, you need to use convergent thinking, where you focus on what one thing you should be doing extremely well . The magic sauce is learning what to say no to.

This is something which entrepreneurs aren’t very good at . It can be heartbreaking to be aware that they have a great opportunity right under their nose, but they do not have the resources , the time , or the bandwidth to be able to explore them in the present. However, that’s the nature of the beast , and founders need to understand that given their constraints , they can’t possibly be doing everything , because this leads to disaster.

It’s important to shoot stuff down. A lot of it you can eliminate straight away , because it’s either irrelevant to your core business ; it’s tangential to your goal ; or there are too many other people doing it. It’s very helpful to have someone else across the table who will tell you what’s wrong with some of your ideas. This is why investors will deliberately play devil’s advocate , and mature entrepreneurs understand the value an investor brings when he chooses to disagree with them. It’s not that he’s trying to be difficult – he’s ultimately doing it to improve the chances of success for the company . The tension arises because he has a long term perspective , as compared to the founder’s short term view of chasing the newest shiny object.

This bifocal perspective can create success, provided you’re both aligned. I always remind my startups that they need to focus on cashflow and profitability , so that they are no longer dependent on the whims and fancies of the investor, and don’t have to waste valuable time raising the next round of funding. This involves getting their hands dirty and doing the daily drudge work . It’s true that the daily grind which is boring , but it can actually be very exhilarating to reach the milestone of cash flow profitability. Once you achieve this state , you no longer need to depend on your investor’s generosity for further funding . The trouble is that when times are good , your investor will promise you the earth and the moon. However, when you can’t deliver and things go sour ( often for reasons beyond your control , and inspite of your best efforts), he may turn around and say, sorry I’m not giving you any more money . You’re then completely at his mercy, and this is never a good situation to be in . As an entrepreneur , you need to understand that your ability to experiment is directly proportionate to how much money you have in the bank. The more the money you have (specially customer generated revenue), the greater your flexibility to bend lots of rules. This buffer will give you a lot more breathing space and the courage to fail as well.

The truth is that investors respect entrepreneurs who’ve generated revenue from their customers. This is true even if they goad you to pursue market share and growth at the expense of profitability .

If you want to make sure that you’re coming from a position of strength, make sure that you become cashflow positive first. Yes, there will be opportunities which you may have to pass on, but don’t worry – if you are willing to be patient, new ones will appear as you evolve. This way you’re never going to be starving for oxygen because you don’t have enough money.

So what are the right paths to explore? Because this depends on hundreds of variables, the answer is going to be unique for each company. However, investors don’t have the right answers either ! We really can’t tell you what you should or shouldn’t do – we can only ask you intelligent questions , so that you can find the answers for yourself. If you realize the critical importance of cashflow , you will be able to set your priorities intelligently, so that you will be able to achieve both your short term goals as well as your long term dreams.