Private data > credit score: Platform tech lenders have a major advantage over other competitors as they have private data fuelling their underwriting algorithms. While we have had marketplaces (Zomato), payments platforms (Paytm) enter into lending in a major way, crucially it is accounting software providers which hold the most relevant information including assets, outstanding debt, capital invested, etc.

Tally is easily India’s most commonly used SMB accounting software. It has a customer base of over 2 Mn businesses (~14 million users) across 100 countries. The company already has in motion a plan to provide billing software to tap the massive landscape of small retailers and automate them. Acquiring the SFB license will allow Tally to provide/ enable working capital, small-ticket loans to SMBs.

As per BCG’s analysis in 2020, the addressable SMB credit demand in India is around $600 Bn, of which 45% of the total credit supply in B2B lending in India is through informal channels and the unorganized market. Lack of adequate and reliable financial data, and higher servicing costs have been the primary factors limiting formal credit access to SMBs in India. Tally’s access to data potentially solves part of the problem.

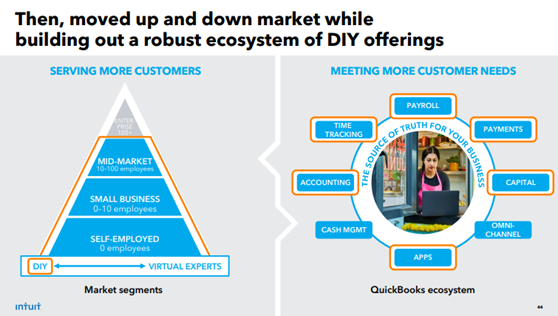

Globally, especially in the USA, Intuit (owner of QuickBooks) has managed to expand its offerings from accounting to tax planning into capital for businesses and credit score especially through its $8.1Bn acquisition of Credit Karma

The Intuit Story:

The stage is certainly set for Tally to make a similar push in India. However, the space is not likely to be without competition. The likes of Vyapar, Khatabook, and OkCredit have acquired a large number of merchants through a free-now, monetize-later app strategy and have raised massive funding from investors. While these digital book-keeping apps have largely catered to Kirana stores/ micro-businesses rather than MSMEs (Tally’s primary user market), there is bound to be overlap in the future with the likes of Vyapar and FloBiz going after mid-sized enterprises.

Pertinently, Khatabook acquired Biz Analyst, a SAAS business management firm, in a $10 million deal in Mar 2021. Biz Analyst helps small and medium-sized business owners make data-driven decisions by providing real-time access to their business data on mobile by connecting them with accounting software Tally.

Lending to MSMEs in India is not an easy execution play —with bad loans in the segment as high as ~11% as per TransUnion Cibil. Collections from such businesses are onerous and often expensive. Our portfolio company Creditas provides a technology-based digital collection and delinquency management platform to lenders to solve exactly this problem. It will be interesting to see how Tally approaches the play. Historically it has brought on-board Chartered Accountants as champions of its accounting software by offering them discounts on the product. Its distribution and collection strategy for lending will certainly be one to keep an eye out for!