Most startups begin with a bunch of friends or associates coming together to solve a problem in a large market. With companies being incorporated at even idea stage, with pressing issues like refining the model, go-to-market strategy, commercialization plan, while supporting burn by bootstrapping, much thought does not go into:

- Co-founder inter-se agreements

- Equitable division of the cap table

For example, a trio comes together to start their own business, and to simplify divides equity equally among each other. A few years of bootstrapping later, one of the cofounders realizes he can not continue his entrepreneurial journey due to personal reasons and quits the startup. The remaining duo continue to build the business but some thoughts always remain in the back of their minds:

- Why should the loyal cofounders create incremental value, with the early leaver retaining all the benefits of value creation?

- How will the remaining cofounders deal with dead equity of a departing cofounder on the cap table?

- Why should the loyal cofounders compensate a late incoming cofounder by diluting their equity if there is dead equity on the cap table?

Entrepreneurship is a tough and lonely journey by itself, and the event of a partner choosing to leave, however amicably, always hurts those who chose to remain loyal to their vision. This creates co-founder conflict, and friends can become enemies very quickly.

The solution

How do we get past such situations? Some cofounders will leave the journey in the middle. The remaining cofounders will pick up the pieces and continue their journey. We intend for solutions to be fair to every party, because we were all partners at some point in time.

A solution we have come across is ‘Reverse Vesting’. While ‘Vesting’ is the process of a founder accruing full rights to equity that can not be taken away by a third party, ‘Reverse Vesting’ is nothing but the obligation of departing cofounders to sell all or part of their equity to the remaining cofounders in case they decide to leave ahead of the vesting period. The founders retain all voting rights for their entire shareholding (vested and unvested) until such time they remain a part of the company. Reverse vesting has no implications on shareholder rights, meaning all cofounders continue to enjoy board representation (if any), dividend rights (if declared) as usual during the vesting period.

The typical vesting period is 4-5 years, with x% of equity vesting for every year the cofounder stays. If a cofounder leaves before all the equity has vested, he/she is obligated to sell the unvested equity to the remaining cofounders at par value.

For example:

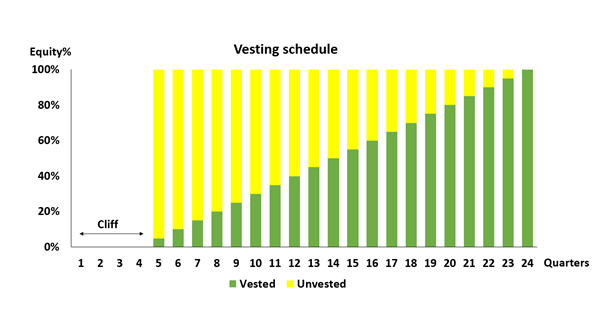

For company ABC, equal cofounders A, B and C have a reverse vesting obligation with a 4-quarter cliff, 5-year reverse vesting period of 5% equity vested every quarter from the start of 5th quarter. This is what the typical vesting schedule will look like:

This simply means that starting quarter 5, 5% of cofounders’ equity will vest every quarter for the next 20 quarters. For cofounder A, it means at the end of year 2, 20% of their equity i.e. 6.66% of the company (20% x 33.3% stake) will vest. The remaining 26.67% stake will remain unvested. In the event the cofounder A decides to leave the company at the end of year 2, they will retain 6.66% equity in the company and will be obligated to sell the remaining 26.67% equity to cofounders B & C equally at par value.

While there is some debate as to whether the unvested shares should be sold back to the company, instead of the founders, to ensure fair stakes for other investors too, we believe that founder shares should go back to the founder pool – thereby incentivising continuing founders in the business while also allowing them the flexibility to onboard new founder(s).

Reverse vesting aligns interests of cofounders in a way that loyal ones enjoy the fruit of their labour, retain their equity, and receive unvested equity of departing founders.

How does Reverse vesting solve problems?

Problem 1

Departing cofounders continue to enjoy the fruits of the labour of loyal cofounders

How Reverse Vesting solves this?

The obligation of departing cofounders to sell their unvested equity to remaining cofounders enables departing cofounders to enjoy the benefits of value creation to the extent of their partnership period. At the same time, since remaining cofounders receive the departing cofounder equity, they are incentivized (and not penalized) for remaining loyal.

Problem 2

Dead equity on the cap table due to cofounder departure

How Reverse Vesting solves this?

By equity vesting only to the extent of the loyalty of the departing cofounder, Reverse Vesting limits the percentage of dead equity on the cap table. Since the unvested equity is back in the hands of the remaining cofounders who continue to drive the business, it increases the skin in their game.

Any cap table having dead equity like inactive/departed cofounder makes for an uninvestable startup. Such startups struggle to raise capital from investors because an inactive major shareholder can cause operational issues in the future. This is an avoidable problem, and consequently, avoidable investment for an incoming investor who might chose to deploy capital elsewhere. Reverse vesting reduces the risk of carrying dead equity on cap tables.

Problem 3

Carving out the equity of a late incoming cofounder

How Reverse Vesting solves this?

Companies onboard late cofounders or elevate key employees to cofounder level later in their journey to fill the shoes of departing ones, strengthen, or retain talent. If a departing cofounder takes their full equity with them, late cofounders have to compensated equity by way of:

- ESOP pool

- Existing cofounder dilution

- Full cap table dilution

None of the above are particularly fair to any party. Every startup needs ESOP pools to strengthen and retain the employees, and carving out a portion off the pool reduces the pool available for employees. If the agreements do not allow using the ESOP pool, the cofounders have to dilute which is again disadvantageous to them. If no agreement is reached and the entire cap table including investor and ESOP pool dilute, it is the most unfair way of carving out equity.

Instead, the equity that a departing cofounder sells to remaining cofounders can be set up in a notional cofounder pool and can be drawn from time to time in case required. At the end of X years, any unutilized equity from the notional pool can be distributed to cofounders on a pro rata basis.

Finer aspects

Cofounder departures are seldom straightforward. While many departures may be due to personal reasons, a choice to pursue a different life path; we have also witnessed departures due to fraud, cheating, and malice.

Consequently, most disagreements over founder vesting arise from the events leading upto the departure that trigger transfer obligations and their terms. We often see terms like ‘good leaver’ and ‘bad leaver’ in cofounder inter-se agreements, which give us a false sense of control over any potential trigger events. However, the reality is far from this.

Good leavers usually arise due to death, disability, divergent life paths, or a dismissal from employment without material cause. Bad leavers are dismissed with cause like fraud, embezzlement, misconduct, etc. In the US, it is common practise to treat all founder departures alike – all leavers are bad leavers. However, we do not subscribe to this thought process.

Naturally, good leavers are better than bad leavers, and we would like the treatment surrounding their equity to also be different. The illustration below explains our thought process on the treatment of equity in both cases:

| Cause | Good leaver | Bad leaver | ||

| Equity | Vested | Unvested | Vested | Unvested |

| Treatment | Retain or Sell | Transfer | Transfer | Transfer |

| Transfer to | RetainorSell to other shareholders | Remaining cofounders or Cofounder pool | Remaining cofounders or Cofounder pool | Remaining cofounders or Cofounder pool |

| Price | Fair market value | Face value | Face value | Face value |

Sample vesting clauses

Vesting of Promoters’ Shares: 25% of the shares held by each Promoter shall be deemed to have vested on the date hereof, and the remaining 75% of the shares held by each Promoter (“Unvested Shares”) will be restricted over a 4-year period starting from the date of Closing (“Vesting Period”). Upon the completion of the first year, the Unvested Shares will be vested in equal instalments, every 3 (three) months, over the next [3 (three)] years and shall cease to be part of the Unvested Shares. It is hereby clarified that the first quarterly vesting shall occur at the end of the 15th (fifteenth) month. In the event of termination of any of the Promoters’ employment with the Company any time during the Vesting Period, only the shares that remain part of the Unvested Shares shall be transferred to the Company and in the event such transfer to the Company is not feasible (by reason of restrictions under applicable law or otherwise), such Unvested Shares shall be disposed of in a manner determined by the Board and the Investors.

Promoters agree not to sell, transfer or encumber their shares in the Company until Investors get exit in terms of this Term Sheet and the Definitive Agreements (“Lock-in Period”). The promoters shares will vest over a period of four years from closing, with 6.25% of shares vesting at the end of each subsequent quarter.

Subject to clause 13(a), Promoters agree not the leave the services of the Company for a minimum period of five (5) years from the date of the closing. Any exception to this will require written consent from the Investors. If any Promoter leaves the Company before this timeframe, in case of death/ disability, vested shares will be transferred to next of kin. In case of exit due to any other reasons, if the Investor Directors agree that it is with good cause, the exiting promoter can still retain their vested shares. Else, the exiting Promoter will have to sell their vested equity to the company which will be utilized in the ESOP.

Closing thoughts

We appreciate the magnitude of problems that Reverse Vesting can solve. We view Reverse Vesting as a tool that cofounders should use to align and protect the interests of every cofounder by lengthening the commitment period, potentially increase skin in the game for loyal cofounders, and reduce the risk of an unattractive cap table.

In due course, we plan to institute the Reverse Vesting policy for all new investments.

We also leave you with some interesting literature on Reverse Vesting that helped shape our views which you will love to read:

- The Terms of Term Sheets (Matrix Partners)

- Founder Share Vesting – Finding the Right Balance (Point Nine)

- Reverse Vesting (Pawel Maj)

We invite your critique on our thoughts. Please write to Siddharth or Dhruv with your inputs.