Most founders get only one chance to raise money from a particular investor, which is why the pitch they make is so vitally important. The trouble with all these pitches is that because all the founders read the same books and use the same templates to create them, they end up looking very similar to each other. This is why they often end up putting the investor to sleep.

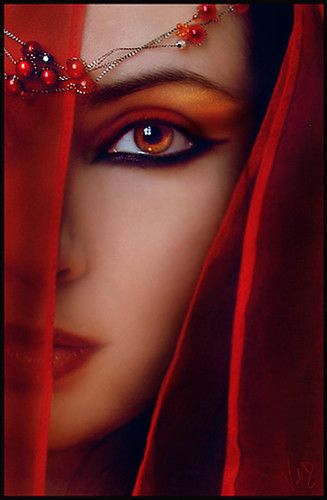

Founders need to work on their pitch in order to stand out from the rest of the competition. You need to think about what makes you different – what makes you memorable. This is why less is more – there is a reason why miniskirts attract more interest than gowns ! The purpose of the pitch is not to get the investor to sign a cheque – it is simply to arouse interest, so you can keep the conversation going. This is why you can’t afford to pad your pitch with the same boring cliches and platitudes which everyone else does .

If you have a generic slide in your presentation, then please take it out. What is a generic slide? It’s a slide which any founder can use, because it’s full of weasel words and jargon which mean very little. They often serve only to switch the investor’s brain off , because he’s heard it all before.

What you really want to do is to make the investor think. You need to provoke him a bit, and the best way of doing this is by asking intelligent questions. For example, if you wanted to create a better online grocery delivery startup , your first slide should ask – Why are companies like Grofer still losing money? This will get his attention, and force him to think, which means he will start actively listening to your presentation. You then need to provide him with a counterintuitive answer, so that whether or not he funds you, at least he will respect your depth of knowledge , and will be happy to continue engaging with you. This is not easy , because you need to have a lot of expertise and a contrarian point of view. It’s hard work to come up with an original perspective, and you won’t be able to use canned presentations.

You need to polish and tailor your pitch, depending on who exactly you’re pitching to. You need to prove to the investor that you’ve done your homework – that you understand his sweet spot and investing thesis. Anticipate his objections, and answer his questions even before he asks them, so he can see you are capable and competent.

The trouble with a lot of pitches is they’re usually peppered with fashionable buzzwords . For example, the current crop of buzzwords is artificial intelligence / deep learning / neural networks/ machine learning. Don’t forget, investors aren’t dumb. We have good bullshit detectors, and it’s easy for us to figure out when the knowledge of the founder is shallow . We can sense when the founder is using jargon only in order to impress the investor , rather than because he actually understands the space.

This lack of depth can backfire. When we ask more probing questions, you’re not going to be able to answer them, and you will end up with egg on your face.

Be creative and innovative when crafting your pitch – make it an original work of art. Take a few risks ! After all, if the definition of an entrepreneur is someone who takes intelligent risks, then why not use your pitch to show investors that you fit the bill !

The good thing about giving presentations is that you will get progressively better, if you ask for feedback. Try to make your presentation short and sweet, so that you leave enough time for the investor to ask you questions, and they want to find out more about what you are doing ! Winston Churchill said it best— ‘A good speech should be like a woman’s skirt; long enough to cover the subject and short enough to create interest.’